Our goal is to offer suggestions, tools and let you know you’re not alone in your financial health journey. Women create the village and sometimes we need a place to have straightforward and honest conversations about the financial challenges that are unique to our circumstances. Because they are real.

Creating Safe Places To Discuss Real Life Financial Challenges

Kamili Samms

About Me

Always having multiple sources of income and adjusting to married life with children became mentally stressful.

Being an independent go-getter, it took some time and lots of soul-searching to finally figure out what I had been experiencing all of those years. It was financial stress.

Here is My Story....

Prior to the onslaught of Covid 19, I was thriving both personally and professionally. I survived the banking collapse era of 2008 and had just left a smaller mortgage company for a position as a Senior Loan Officer with a national mortgage lender. In a short amount of time, I more than doubled my income, grew my book of business, and was being recognized by my industry peers as a top producer. My kids were doing well in their private schools, and my husband and I were preparing to buy a house.

In 2020 and 2021, the aggression of Covid 19 brought historic drops in interest rates and my business went through the roof. I was earning a healthy six figures and as a result of the lockdown, we didn’t have the normal daily expenses. With the extra income and savings, I was able to pay off all my credit cards, saved more than six months of monthly expenses and we purchased a house. I wasn’t naive in thinking the constant earnings increase would continue at this pace, but no one could predict what was coming on the horizon.

The mortgage business was continuing to decline and the forecast for the real estate industry was becoming more and more cloudy. I was separating from my husband after 20 years of marriage and trying figure out how to reestablish life on my own. Throughout the summer of 2022 my job status was shaky due to the lack of business resulting from drastic increase to historically high interest rates.

Unfortunately, the mortgage market continued to experience shifting sands and I found myself involved in another company change - this time spearheaded by the lending team itself. Instead of continuing in this shifting employment cycle, I made the decision to venture out on my own. It was the right decision for a lot of reasons, but didn’t solve the immediate needs. My expenses were increasing exponentially, money wasn’t coming in, my assets and savings were depleted and I exhausted access to personal loans. In addition to this, the business expenses related to licensing and startup costs were beginning to stack up. Life seemed so sudden and all of it was mounting at one time.

Finally, in September I made the difficult decision to leave my company before the layoff hit my desk. Although panic had not fully set in, it was starting to show its’ face but I had to remain sure I would land on my feet. This was the impetus for creating my own path.

Panic attacks were becoming constant, doubt was creeping in and I was wondering if I should just get a job. Then it clicked. I recognized that through this whole period there were so many signs affirming I was on the right path. Yes, this period was mentally and financially painful, but I was surviving and I could see where all of this was going. I knew I had to be focused and strategic to navigate the choppy waters of this season.

Professionally, I frequently speak with people about the importance of financial health. I find that generally most, including myself, do the minimum to be ready for shifting seasons - which is guaranteed to happen.

One thing that is absolutely clear - preparation is a vitally constant task. It is my hope that by sharing my stories and experiences of 20 years as a real estate finance professional, I can help others prepare for all of the different seasons life offers and avoid some costly pitfalls.

Women and Finance

It's Who We Are

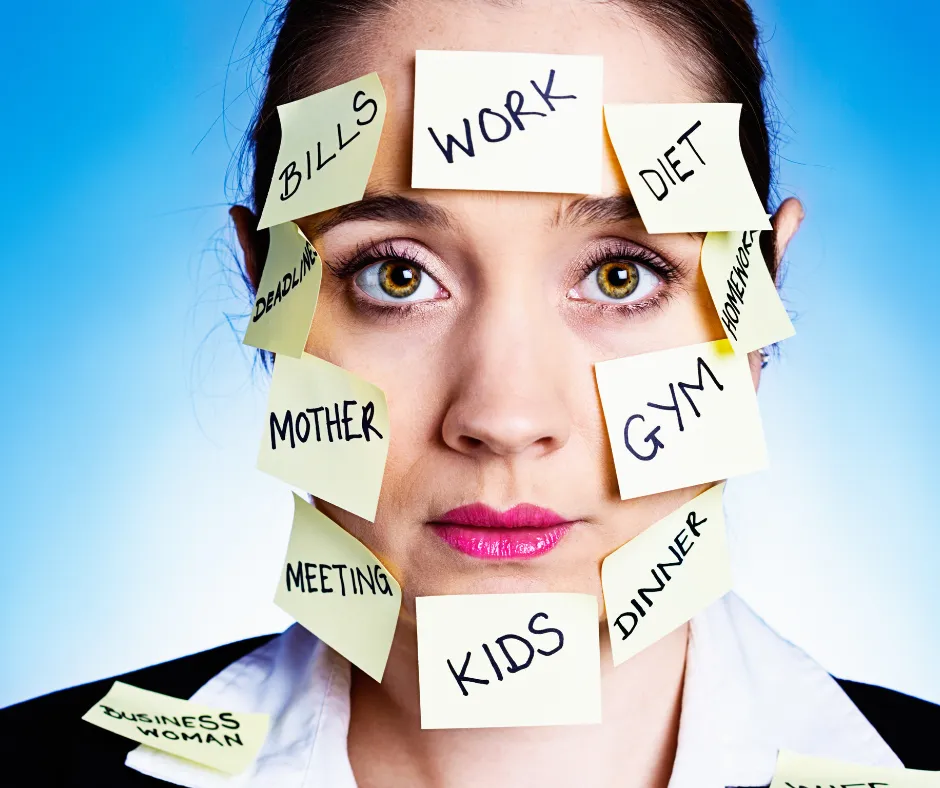

Women juggle personal, family, professional, financial, and a broad range of other demands across their lifespan. Stress, distraction, fatigue, and reduced sexual desire are all byproducts of women shouldering the emotional toll of simultaneously caring for young children or other ill/elderly family members, coping with their own chronic medical problems, feeling depressed and experiencing relationship tension or abuse, AND dealing with work problems. No wonder we need a mani/pedi every 2 weeks!

Here are the plain and simple bullet points to get your attention.

In The United States:

Women Live Longer Than Men By 6 Years

African-American Women Live Longer Than Men By

7 Years

Latina Women Live Longer Than Men By

5 Years

Asian-American Women Live Lonver Than Men By

4 Years

YOU GET THE POINT - WE'RE GOING TO LIVE LONGER

Which Means This:

Women will need more money than men to last those additional years.

Women will inherit their husband's wealth.

Women are more likely to inherit their family wealth.

After divorce, women will need to know how to either manage the financial settlement received, adjust to living on one income, and/or both.

Many women are the higher earner in the family and need to have more understanding of how money works.

Our Offerings

Tailored programs for lasting results.

Financial Health Defined

Financial health is a composite measurement of an individual's financial life. Unlike narrow metrics such as credit scores, financial health assesses whether people are spending, saving, borrowing, and planning in ways that will enable them to be resilient and pursue opportunities.-

Financial Health Network

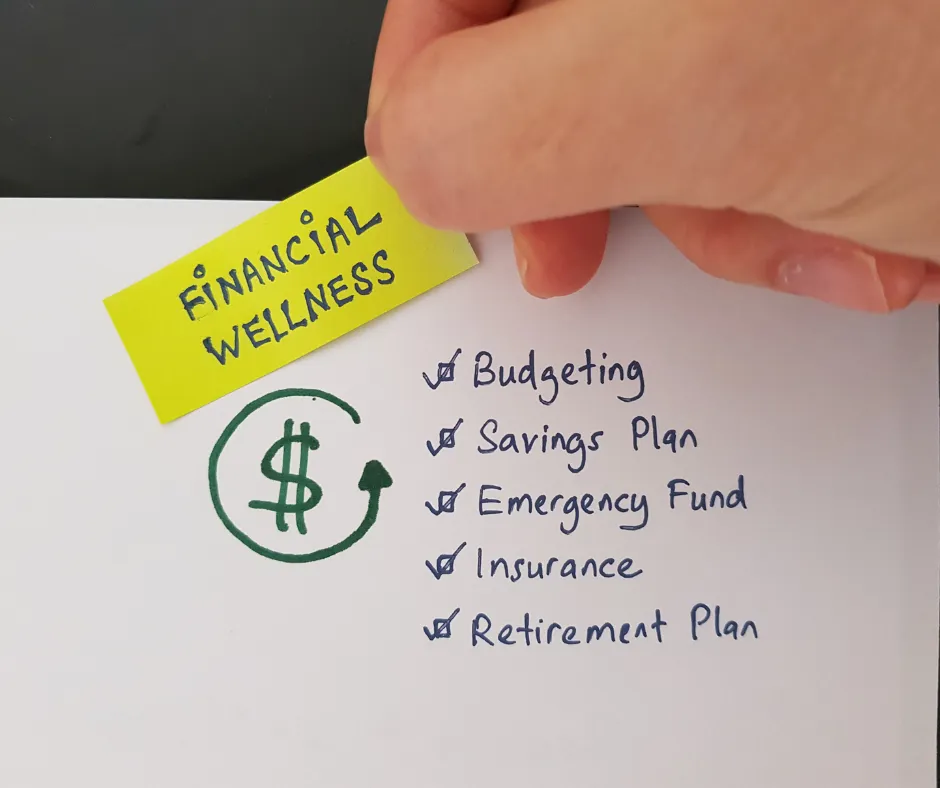

Where do you start?

Creating a budget and checking your credit scores are the first steps to becoming financially healthy. But there's more to it than those two steps. After you have a handle on how much income is coming in and how much is going out every month, the next steps are creating a savings plan and paying down debt.

How to tell if you are financially healthy?

Managing money can be one of the most stressful tasks we face as adults. The best way to measure financial health is by analyzing your finances - and then evaluate your stress levels when thinking about money. If there isn't enough income to pay all of your expenses on-time or extra-curricular spending is out of hand - then there is definitely work to be done!

Save for your future self

- invest to build wealth

The common final steps in becoming financially healthy typically includes creating enough savings for retirement. But what really separates those who live comfortably after retirement and those who live well and have something to pass onto their heirs - is investing. This is what allows your money to make money and grow

Get Your Optimizing Your Financial

Health Workbook

In a world where financial uncertainties loom at every corner, finding peace and prosperity can often seem like a distant dream. But within the pages of this workbook, a beacon of hope and guidance awaits.

This financial health workbook is not just a tool, but a journey towards Understanding Financial Health and the 7 steps to building financial health.

"Optimizing Your Financial Health Workbook"

This workbook isn't just about managing money; it's about transforming your relationship with finances to one of understanding, grace, and growth. It's about seeing beyond the numbers to the life of abundance.

Take the first step on your journey to financial freedom and wellbeing. Embrace the opportunity to mold your financial future into one of peace and prosperity.

Purchase "Optimizing Your Financial Health Workbook" today, and discover the joy of a life led by faith, financial wisdom, and freedom.