Get Your

Optimizing Your Financial Health

Workbook

In a world where financial uncertainties loom at every corner, finding peace and prosperity can often seem like a distant dream. But within the pages of this workbook, a beacon of hope and guidance awaits.

This financial health workbook is not just a tool, but a journey towards Understanding Financial Health and the 7 steps to building financial health.

"Optimizing Your Financial Health Workbook"

This workbook isn't just about managing money; it's about transforming your relationship with finances to one of understanding, grace, and growth. It's about seeing beyond the numbers to the life of abundance.

Take the first step on your journey to financial freedom and wellbeing. Embrace the opportunity to mold your financial future into one of peace and prosperity.

Purchase "Optimizing Your Financial Health Workbook" today, and discover the joy of a life led by faith, financial wisdom, and freedom.

TIME IS RUNNING OUT

INTRODUCTORY DISCOUNT FOR A LIMITED TIME

Optimizing Your Financial Health Workbook

ACT FAST! REGULAR 29.99

INTRODUCTORY OFFER 17.99 ENDING SOON...

Knowledge Is Power:

giving you the tools to transform your financial goals into workable solutions

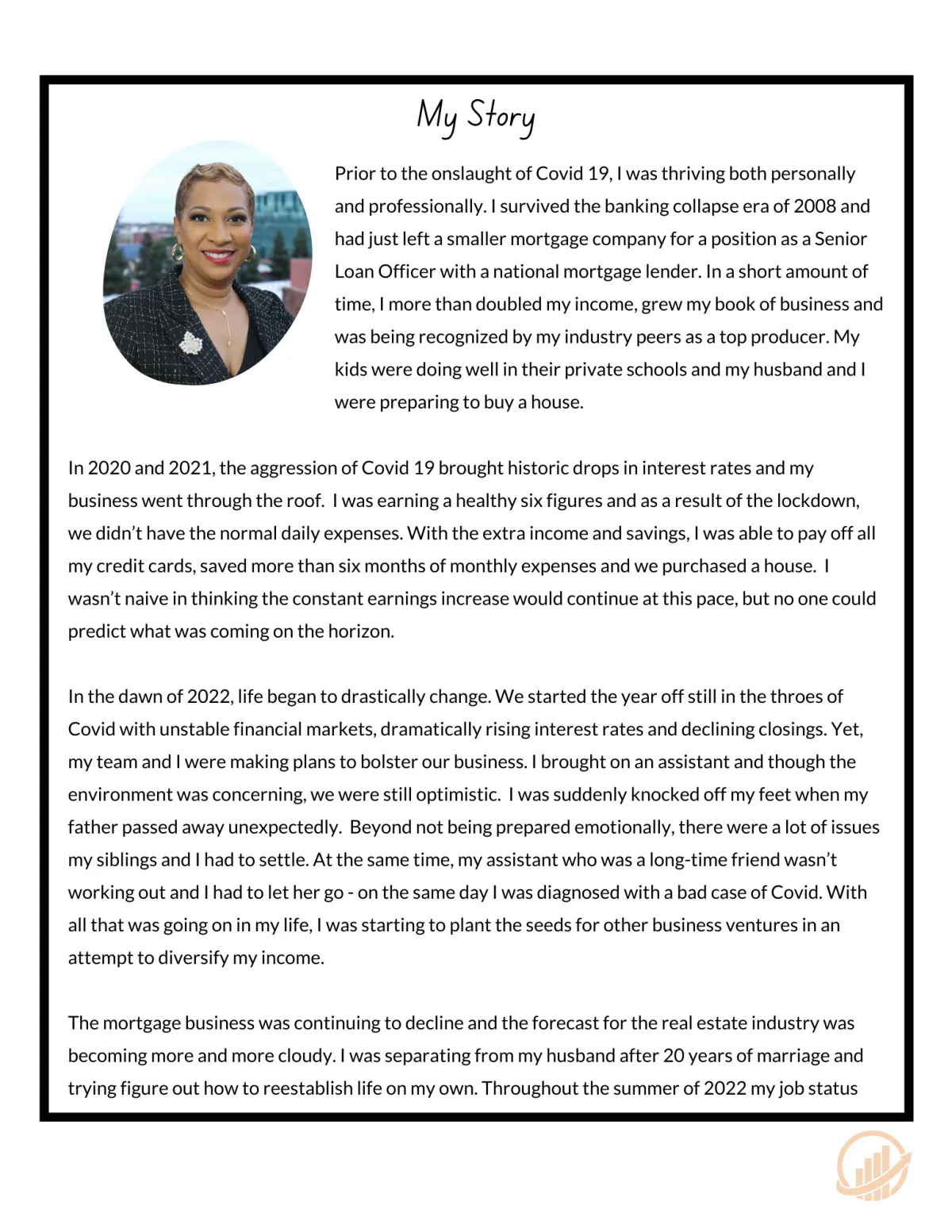

I can tell you for certain that I would not have been able to survive these past couple of years had I not had the financial knowledge to help navigate me through the most stressful period in my life. As a mortgage loan officer for the past 20 years, my knowledge of the credit world saved me from financial ruin. It’s what has helped me maintain my credit score (knock on wood – which is typically the side of my head!). It helped prepare me for the moving out of the house we had just bought and into my own apartment at the beginning of the separation. It helped me retain my father’s house (which was our family home that witnessed 4 generations pass through its doors) out of the reverse mortgage after his sudden death.

Now, I’m passing the wealth of that knowledge into this workbook so that you too may be empowered. Learn the importance of being prepared for what financial challenges lurk around the corner. This workbook will help you ‘plan for the unplanned’ by providing the tools and information which will help you either get back on track or build a more solid foundation, so you are less likely to fall off the track in the first place.

The 3-part approach first takes you through ‘7 Steps to Building Financial Health’. This section will take you step by step from establishing an emergency savings to evaluating if more income is needed to help balance your budget. My years of experience in speaking to clients helping them navigate their finances from a creditor’s perspective is included in these tools.

Next, you will take a journey through your big life dreams and goals. The question to ask yourself is ‘What do you want to do now that you’re all grown up?’. You will not only help discover those answers but find ways to make those goals become reality!

Finally, the last part takes a deeper dive into your relationship with money. How did your parents influence your money-making decisions? What was their approach to handling finances? How does spending money make you feel? Understanding the answers to these and other questions will not only help you improve your relationship with money but it will help you flourish into the financially healthy individual you deserve to be.

Sprinkled throughout the workbook is helpful tips on keeping your sanity along the journey. Financial stress is a real emotion we experience during financially challenging moments. It can be immobilizing, trigger depression, and bring on physical symptoms not previously experienced. Finally, there is a place that understands your pain and the Optimizing Your Financial Health Workbook is the first towards becoming more knowledgeable and powerful!

Here's a peak inside: